If you miss the current PREMIUM SELLER’S MARKET, you better hang on for the ride, and a long ride it might be…

It is undeniable we are currently in a Premium Seller’s Market. Business owners that are electing to sell all or a portion of their business are realizing some of the highest values in history. Many business owners ask us how much longer it might be until we drop into a neutral (normal) market and then into a much less attractive buyer’s market. 2015 M&A activity looks like it will be about 8% above 2014 numbers. According to Intralinks®, this matches 2007’s record for M&A activity. Clearly we are in a Premium Seller’s Market.

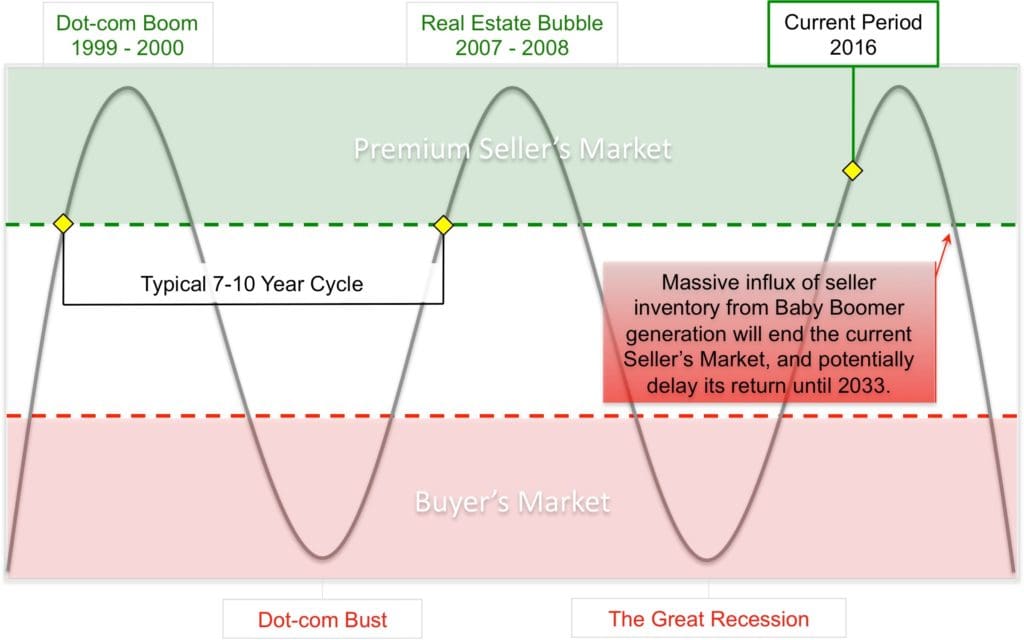

M&A Market Cycles

If you look back historically (literally to the great depression) you will see like clockwork a Premium Seller’s Market every 7 to 10 years. The chart above simply picks up the trends since the late 1990’s. As you can see the market peaked in 2000 and then the tech bubble imploded. We saw recovery beginning in 2004, which culminated in the housing bubble in 2007/2008. Presently, we are 8 years into the cycle and at higher M&A levels than the peak of 2007. How much longer will this Premium Seller’s Market last? No one has a crystal ball, but most analysts speculate we will see strong M&A activity through the first half of 2016, with a meaningful slowdown heading into 2017.

So a very important question for business owners to ask is: Do I sell when I’m ready or when the market is ready?

- Premium Seller’s Market – Historically can see 1 – 2 higher EBITDA turns in value

- Normal Market – Historically neutral enterprise value

- Buyer’s Market – Historically up to a 50% discount of a normalized market

If we assume a peak M&A market in 2016 and using history as a guide, we could expect another Premium Seller’s Market in 2023/24. That said, 7 years does not appear to be a typical historical market due to the amount of Baby Boomer seller inventory hitting the market. There are 8,000 baby boomers retiring each day in the U.S. and 14% are business owners so that’s 1,120 business owners a day hitting retirement age. How will that compound over the next 5 to 10 years? It seems clear to many analysts that supply will out-weigh demand which could push the next Premium Seller’s Market much further into the future.

Is it too late to prepare and get into the market now while valuations are near an all time high?

Flatirons Capital Advisors’ FAST TRACK PROGRAM

For companies that qualify we can typically have offers in hand within 45 to 60 days from the date of engagement. With thousands of strategic public, private, and financial buyer relationships, we help our clients attract the most optimal partners and fast! To discuss our qualifications and receive a free, no obligation consultation regarding your business contact Flatirons Capital Advisors at 720-328-1128 or email at mailto:[email protected].

About Flatirons: Flatirons Capital Advisors, LLC (www.flatironscap.com) is a family-owned investment banking firm that helps privately held companies sell their businesses, acquire other businesses, and raise capital. Our services include accomplishing mergers and acquisitions, obtaining financing, sourcing loans for distressed or bridge finance situations, and financial restructuring. Our unique business model affords sell-side advisory clients the ability to improve their company’s performance, earnings and effectiveness in the short-term, while simultaneously increasing their market value for a future sale. Flatirons has offices in Denver, Chicago, and Dallas.